Accounting knowledge and skills

Accountants must be able to apply accounting theories, principles and practices to meet business and management needs in compliance with accepted accounting standards, rules, regulations and legal requirements.

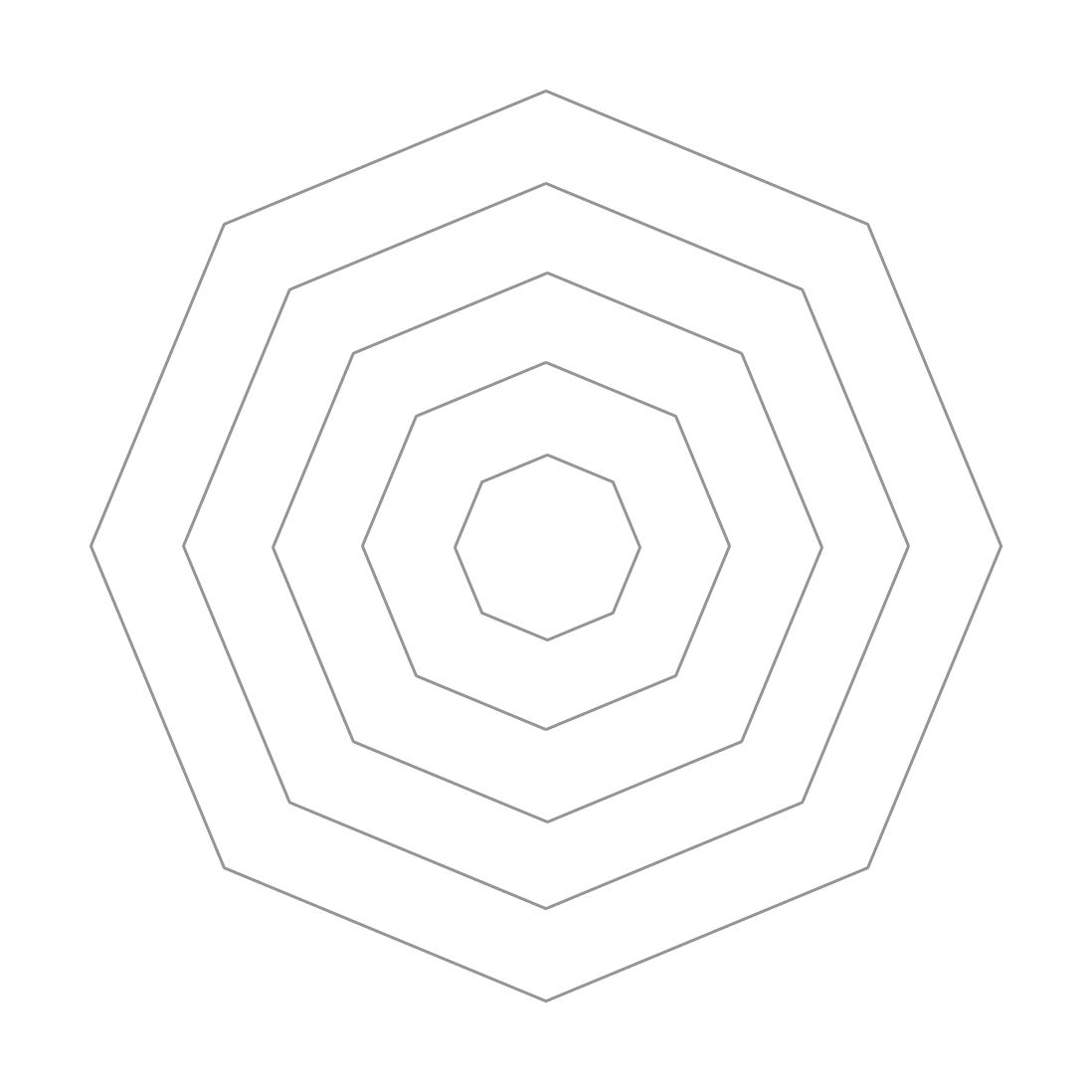

Physical Abilities

Physical abilities

Importance:1 (Max:5)

Skill is rarely required

Technology Skills

Technology skills

Importance:4 (Max:5)

Skill is frequently required

Cognitive Abilities

Cognitive abilities

Importance:3 (Max:5)

Skill is basically required

Comprehension And Expression

Comprehension and expression skills

Importance:5 (Max:5)

Skill is required all the time

Social Skills

Social skills

Importance:4 (Max:5)

Skill is frequently required

Organisation And Execution Skills

Organisation and execution skills

Importance:5 (Max:5)

Skill is required all the time

Problem Solving Skills

Problem solving skills

Importance:5 (Max:5)

Skill is required all the time

Management Skills

Management skills

Importance:5 (Max:5)

Skill is required all the time

Accountants must be able to apply accounting theories, principles and practices to meet business and management needs in compliance with accepted accounting standards, rules, regulations and legal requirements.

Accountants must be able to compile and examine various financial statements and reports to assure their accuracy, integrity and conformance to accepted financial rules, regulations, polices and guidelines.

Accountants must be able to analyse various financial ratios and indicators for evaluating the financial status of an organisation to ensure that it operates efficiently and effectively.

Accountants need basic computer skills. They should be comfortable using spreadsheets and accounting software.

Accountants are responsible for producing audit reports. They must pay attention to details to avoid making errors and to spot errors that others have made.

Accountants have control of an organisation's accounting documents, which they must use properly and keep confidential. It is vital that they keep records confidential.

Accountants deal with numbers and they are required to be good at basic arithmetic.

Academic qualification

A recognised bachelor's degree in accountancy

Professional qualification

Certified Public Accountant (CPA) registered with the Hong Kong Institute of Certified Public Accountants, or equivalent

Experience

3 to 5 years of audit/ accounting experience

Monthly Salary $18,000-$25,000

Monthly Salary $25,000-$40,000

Monthly Salary $30,000-$50,000

Monthly Salary $40,000-$100,000

Monthly Salary $100,000-$250,000

Monthly Salary Master Pay Scale Point 30-44

Monthly Salary Master Pay Scale Point 45-49

Monthly Salary Directorate Pay Scale Point 1

Monthly Salary Directorate Pay Scale Point 2

Monthly Salary Directorate Pay Scale Point 3

Monthly Salary Master Pay Scale Point 14-27

Monthly Salary Master Pay Scale Point 28-33

Monthly Salary Master Pay Scale Point 34-44

*For more details on Civil Service Pay Scales, please visit website of the Civil Service Bureau.

http://www.csb.gov.hk/english/admin/pay/952.html

Degree or above

Higher Diploma