Knowledge on anti-laundering regulations

Anti-Money Laundering Officers require thorough knowledge on anti-laundering regulations to ensure compliance with anti-money laundering requirements.

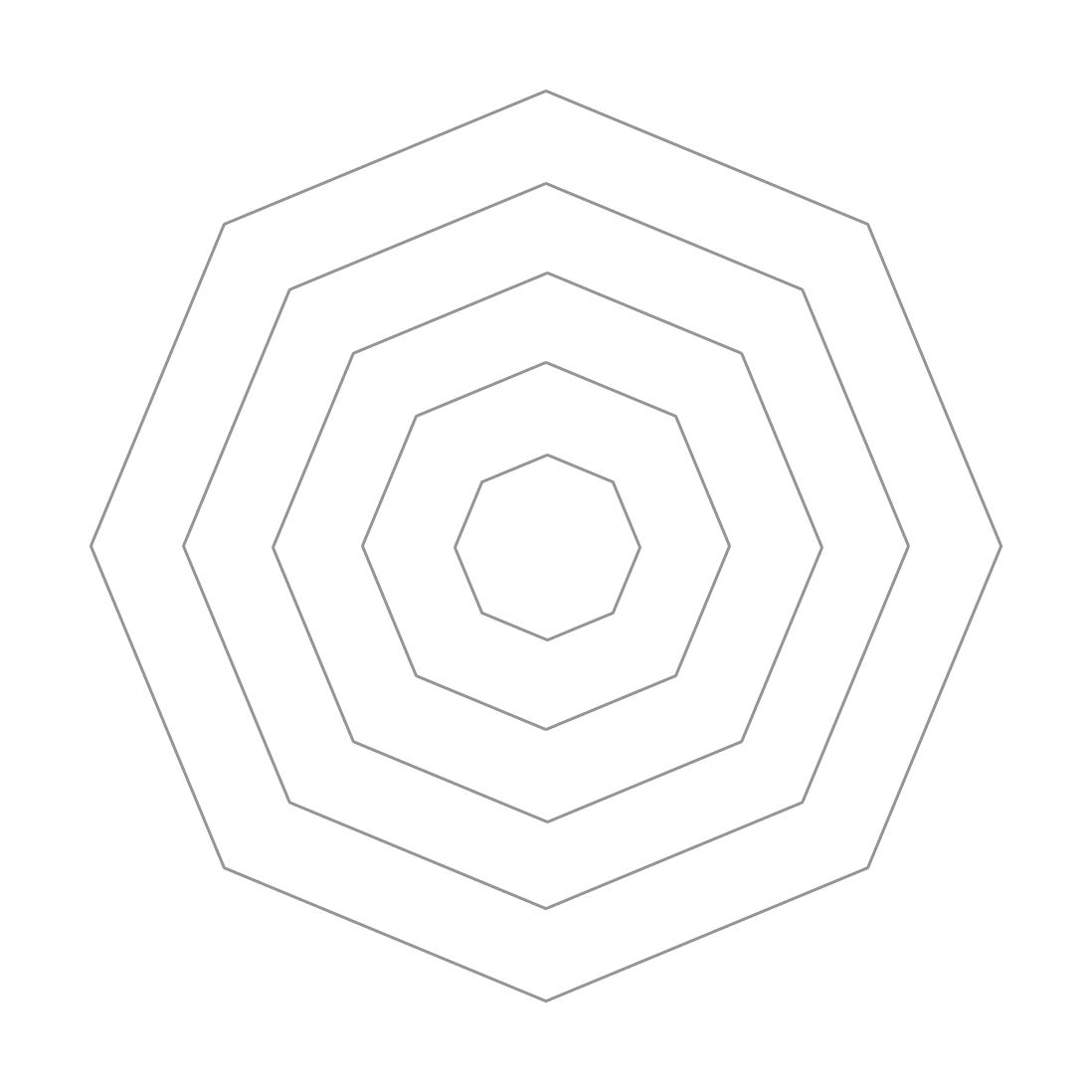

Physical Abilities

Physical abilities

Importance:1 (Max:5)

Skill is rarely required

Technology Skills

Technology skills

Importance:4 (Max:5)

Skill is frequently required

Cognitive Abilities

Cognitive abilities

Importance:3 (Max:5)

Skill is basically required

Comprehension And Expression

Comprehension and expression skills

Importance:4 (Max:5)

Skill is frequently required

Social Skills

Social skills

Importance:3 (Max:5)

Skill is basically required

Organisation And Execution Skills

Organisation and execution skills

Importance:4 (Max:5)

Skill is frequently required

Problem Solving Skills

Problem solving skills

Importance:4 (Max:5)

Skill is frequently required

Management Skills

Management skills

Importance:4 (Max:5)

Skill is frequently required

Anti-Money Laundering Officers require thorough knowledge on anti-laundering regulations to ensure compliance with anti-money laundering requirements.

Anti-Money Laundering Officers may make decisions for potential money laundering risks.

Anti-Money Laundering Officers must evaluate information carefully and be able to make final decision.

Academic qualification

A recognised bachelor's degree in business administration, finance, accounting, economics or equivalent

Monthly Salary $20,000-$40,000

Monthly Salary $60,000-$80,000

Monthly Salary $40,000-$160,000