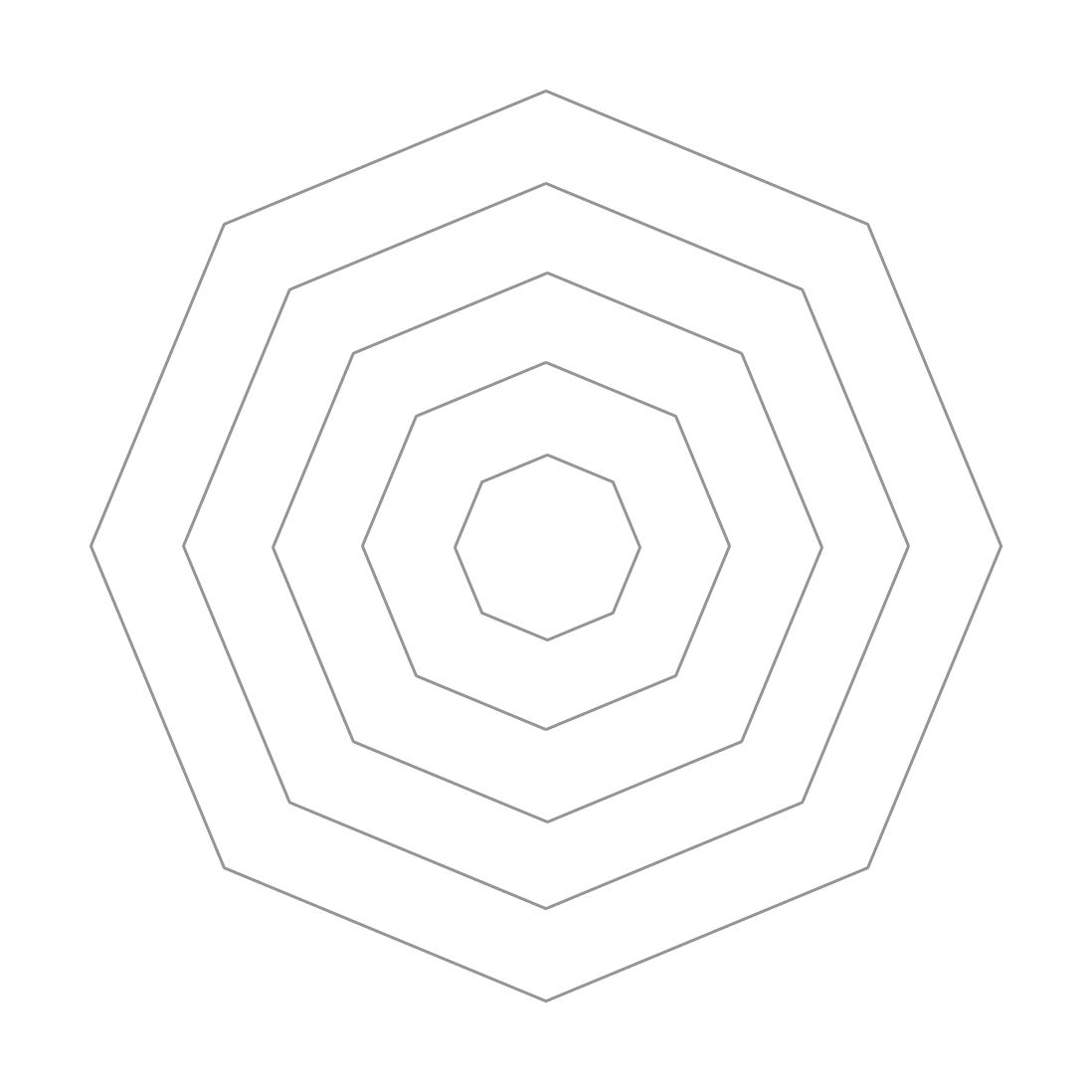

Decision-making skills

Decision-making skills are important for Credit Officers, who must assess an applicants' financial information and decide whether to award loan.

Physical Abilities

Physical abilities

Importance:1 (Max:5)

Skill is rarely required

Technology Skills

Technology skills

Importance:4 (Max:5)

Skill is frequently required

Cognitive Abilities

Cognitive abilities

Importance:3 (Max:5)

Skill is basically required

Comprehension And Expression

Comprehension and expression skills

Importance:4 (Max:5)

Skill is frequently required

Social Skills

Social skills

Importance:3 (Max:5)

Skill is basically required

Organisation And Execution Skills

Organisation and execution skills

Importance:4 (Max:5)

Skill is frequently required

Problem Solving Skills

Problem solving skills

Importance:4 (Max:5)

Skill is frequently required

Management Skills

Management skills

Importance:4 (Max:5)

Skill is frequently required

Decision-making skills are important for Credit Officers, who must assess an applicants' financial information and decide whether to award loan.

Credit Officers must pay attention to details when reviewing applications.

Academic qualification

A recognised bachelor's degree in business, finance, risk management, statistics or other related disciplines

Monthly Salary $20,000-$30,000

Monthly Salary $40,000-$60,000

Monthly Salary $40,000-$160,000