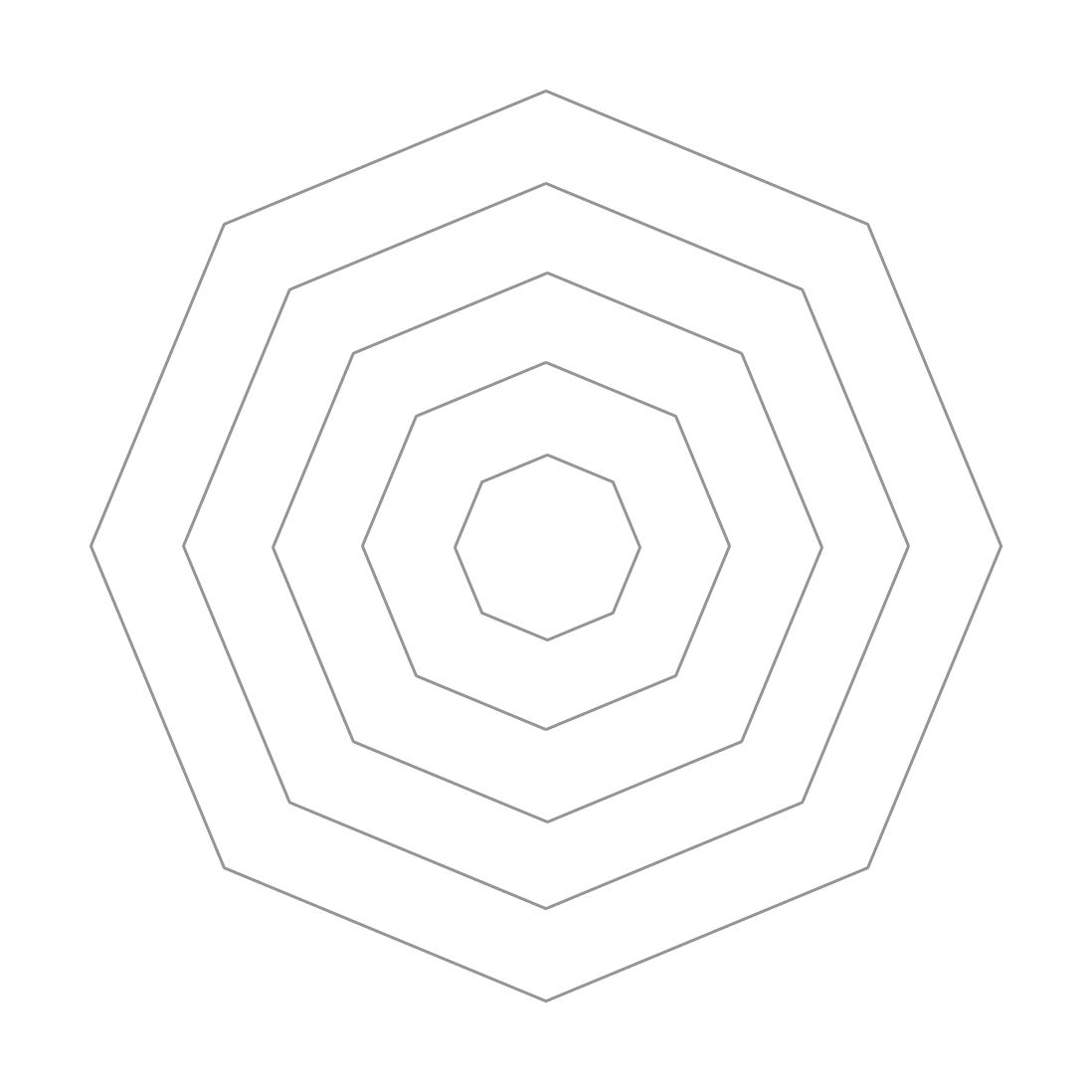

Analytical skills

Tax Partners must be able to identify issues in documentation and suggest solutions.

Physical Abilities

Physical abilities

Importance:1 (Max:5)

Skill is rarely required

Technology Skills

Technology skills

Importance:4 (Max:5)

Skill is frequently required

Cognitive Abilities

Cognitive abilities

Importance:3 (Max:5)

Skill is basically required

Comprehension And Expression

Comprehension and expression skills

Importance:5 (Max:5)

Skill is required all the time

Social Skills

Social skills

Importance:5 (Max:5)

Skill is required all the time

Organisation And Execution Skills

Organisation and execution skills

Importance:5 (Max:5)

Skill is required all the time

Problem Solving Skills

Problem solving skills

Importance:5 (Max:5)

Skill is required all the time

Management Skills

Management skills

Importance:5 (Max:5)

Skill is required all the time

Tax Partners must be able to identify issues in documentation and suggest solutions.

Tax Partners must pay attention to details when examining documentation.

Tax Partners must be able to lead their subordinates in departments successfully by coordinating policies, people, and resources.

Tax Partners must be able to apply tax knowledge and skills.

Academic qualification

A recognised bachelor's degree in accountancy

Professional qualification

Certified Public Accountants (CPA) recognised by the Hong Kong Institute of Certified Public Accountants, or equivalent

Experience

usually over 10 years of relevant supervisory experience is required

Other specific requirements

with multinational corporation experience is an advantage

Monthly Salary $15,000-$30,000

Monthly Salary $25,000-$50,000

Monthly Salary $50,000-$70,000

Monthly Salary $120,000-$300,000

Degree or above